Where can I get NACVA CVA exam certification tips? Latest CVA exam dump, CVA pdf, And online hands-on testing free to improve skills and experience, 98.5% of the test pass rate select lead4 through CVA dump: https://www.leads4pass.com/cva.html (latest update)

NACVA cva exam pdf free download

[PDF Q1-Q13] Free NACVA CVA pdf dumps download from Google Drive: https://drive.google.com/open?id=1GpmRmltvsfdPUXRdcfa9ZxiIM88CEO2U

CERTIFIED VALUATION ANALYST (CVA): https://www.nacva.com/cva

Real and effective NACVA CVA exam Practice Questions

QUESTION 1

Supermajority vote requirements and state dissolution statues are the factors that influence:

A. Swing vote

B. Blocking power

C. Lack of control discount

D. Ultimate rate of return produced by the interest.

Correct Answer: C

QUESTION 2

The most prevalent measure for assessing the likelihood of receiving future preferred dividends is the

company\\’s_________________, commonly defined as the sum of pretax income plus interest expense divided by the

sum of interest expense plus preferred dividends adjusted for tax.

A. Variable-charge coverage ratio

B. Fixed-charge coverage ratio

C. fixed-charge leverage ratio

D. fixed-charge liquidity ratio

Correct Answer: B

QUESTION 3

Which of the following assumption is a base for the process of unlevering and relevering betas to an assumed capital

structure?

A. Business interest subject to valuation has the ability to change the capital structure of the subject company

B. Investors are risk averse

C. Subject companies are at market value in this process

D. The amount of debt and equity at market value.

Correct Answer: A

QUESTION 4

Which of the following factors is NOT considered, among others, when determining if quantitative adjustments to the

sales comparison data are necessary?

A. Age of each transaction

B. Land-to-building ratio of each property

C. Absolute location and relative location of each property in relation to population centers, highways, and so forth

D. Safety aspects of each property

Correct Answer: D

QUESTION 5

If one assumes that the business will continue indefinitely as a viable going concern after the number of years for which

discrete projections were made, the procedure/s commonly used to estimate the terminal value at the end of discrete

projection period is/are:

A. Capitalization of ongoing economic income

B. An estimated market multiple of the economic income projected for the last year of the discrete projection period

C. Discounted net cash flow available to equity

D. Perpetual growth model using net flow available to equity

Correct Answer: AB

QUESTION 6

_________________ are excellent sources of statistical, analysis and projections of regional, national and international

economic and financial conditions.

A. Bank reviews

B. Bank letters

C. Federal reserve bulletin

D. Economic summaries

Correct Answer: B

QUESTION 7

____________ indicates that the collective going-on concern value of the total subject entity is less than the sum of the

individual values of the entity\\’s total tangible assets.

A. Goodwill

B. Positive goodwill

C. Negative goodwill

D. Trademarks

Correct Answer: C

QUESTION 8

The discount rate is a market-driven rate. It represents the expected yield rate-or rate of return-necessary to induce:

A. Investors to commit available funds to the subject investment, given its level of risk

B. Yield rate

C. Dividends

D. Investment yield

Correct Answer: A

QUESTION 9

For valuation purposes, the measurement of economic income to be analyzed can be defined in several different ways.

Different measurements of economic income that are commonly analyzed in this approach include the following

EXCEPT:

A. Payouts (e.g. dividends, interest, security sales proceeds, or partnership withdrawals)

B. Cash flow (often measured as net cash flow)

C. The discount rate

D. Some measure of accounting earnings (often net income or net)

Correct Answer: C

QUESTION 10

Fisher Black developed a technique to value American stock options using the Black- Scholes model called the pseudoAmerican call option model. The steps in the method are as follows EXCEPT:

A. Compute the adjusted market price of the stock by deducting the present value, using the risk-free rate, of the future

dividends payable during the remaining life of the option

B. For each pseudo-option assumed to expire on a dividend date, deduct from the exercise price of the option the

dividend payable on the date and the present value, using the risk-free rate, of all the remaining dividends to be paid

after the dividend date during the term of the option

C. Select the European option with the highest value as the value of the American option

D. Using the Black-Scholes model, compute the value of each of the pseudo-options using unadjusted underlying stock

price.

Correct Answer: D

QUESTION 11

Normally, the business will realize the economic benefit of the prepaid expenses within the normal course of one

business cycle. Therefore, normally:

A. Revaluation adjustment is required

B. No revaluation adjustment is required

C. No revaluation adjustment is required with respect to recorded prepaid expenses

D. Revaluation adjustment is required with respect to recorded prepaid assets

Correct Answer: C

QUESTION 12

The analyst should compare the backlog on the valuation date with that on previous dates. Such comparison, especially

with the backlog one year prior to the valuation date, is one of:

A. The company\\’s future prospects

B. Indication of process continuous process delay

C. The company\\’s order blockage phenomenon

D. The future availability of suppliers

Correct Answer: A

QUESTION 13

The capital stock of a corporation, its net assets and its share of stock are entirely different things… the value of one

bears no fixed or necessary relation to the value of the other; because:

A. A share of common stock does not represent a share in the ownership of the assets of a business.

B. Shareholders are only concerned with dividends

C. Only the corporation itself holds to all its assets and liabilities … A thirsty shareholder of brewery cannot walk into

“his” company and demand that a case of beer be charged to his equity account

D. Putting capital in stocks is somewhat a risky investment

Correct Answer: AC

Share leads4pass NACVA CVA Discount codes for free 2020

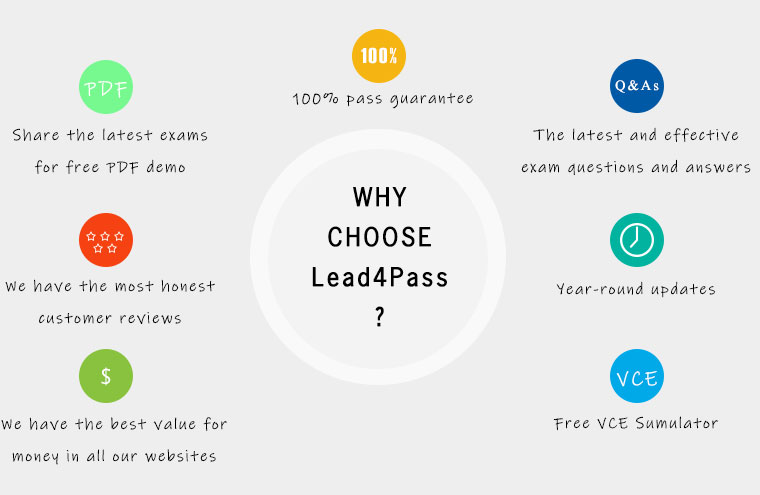

leads4pass Reviews

leads4pass offers the latest exam exercise questions for free! NACVA exam questions are updated throughout the year.

leads4pass has many professional exam experts! Guaranteed valid passing of the exam! The highest pass rate, the highest cost-effective!

Help you pass the exam easily on your first attempt.

What you need to know:

VceCert shares the latest NACVA CVA exam dumps, CVA pdf, CVA exam exercise questions for free. You can improve your skills and exam experience online to get complete exam questions and answers guaranteed to pass the exam we recommend leads4pass CVA exam dumps

Latest update leads4pass cva exam dumps: https://www.leads4pass.com/cva.html (251 Q&As)

[Q1-Q13 PDF] Free NACVA CVA pdf dumps download from Google Drive: https://drive.google.com/open?id=1GpmRmltvsfdPUXRdcfa9ZxiIM88CEO2U

Discover more from Provide the most popular Cisco (CCNA, CCNP, CCIE, CCDP...) IT certification exam questions and answers, exam dumps, Leads4pass expert team will help you easily obtain Cisco, Microsoft, CompTIA, Citrix, Amazon IT certification

Subscribe to get the latest posts sent to your email.

Recent Comments